Dreaming of starting your own business? At Grønlandsbanken, we make it easy to get off to a good start. We offer a solution that includes exactly the banking products you need to establish your business – no more, no less.

We’ll help you get started

Starting a business requires capital – but how much depends on the type of business and your specific needs. That’s why it’s important to have a clear business plan and a realistic budget. It helps you get an overview of how much financing you’ll need – both to launch and to keep your business running during the critical early phase.

We’re here to help you find the financing solution that best suits your needs.

Grønlandsbankens primary products for entrepreneurs

Accounts and Online banking: Business account for your company. Business online banking with extended features.

Loans and credit: Business credit for operational financing. Business loans for investment in property, equipment, etc.

Guarantees: Performance guarantees for executing contract work. Payment guarantees for suppliers providing credit.

Consulting and advisory: Financing, business plans, budgeting, sustainability, investments, and more.

What does the bank require from an entrepreneur?

Account and online banking

To open a business account and online banking, you must have a CVR number.

Additionally, you must submit identification documents depending on the type of business entity.

There is a monthly fee for using business online banking.

Loans and credit

The bank requires a credit assessment based on submitted financial statements, budgets, business plans, etc.

Loans for investment financing typically require a certain level of equity.

There are costs for setup, interest during the loan period, and credit fees.

Guarantees

An enterprise contract or supplier agreement must be submitted, along with information for a credit assessment.

There are setup costs, as well as fees during the guarantee period.

Entrepreneurship Financing

Financing entrepreneurship can be a challenge, as there is often a period with expenses but no income. Losses and negative equity are the consequence of expenses exceeding income. In the bank's credit assessment, there is typically a requirement for a positive result and a minimum equity of 20%.

Therefore, many benefit from seeking startup financing through organizations like Nalik Ventures and/or securing financial contributions from private investors/lenders. This is also a way to improve your chances of obtaining a loan from the bank. We are happy to advise on where and how you can seek financial support.

Many also seek financing for their entrepreneurial ventures in other ways, such as through crowdfunding, Business Angels, or family and friends who are willing to help. You are welcome to have a conversation with us about the various options.

Tools for Entrepreneurship

Nalik Ventures offers a range of tools for entrepreneurs, which can be used when submitting information to the bank.

You can find tools such as:

Templates for Operational Budget, Cash Flow Budget, and Startup Budget

Templates for Business Plan, Business Model Canvas

Information on funding opportunities and advisory services

Nalik Ventures

Read more about support and find templates for business plans and budgets on Nalik's website.

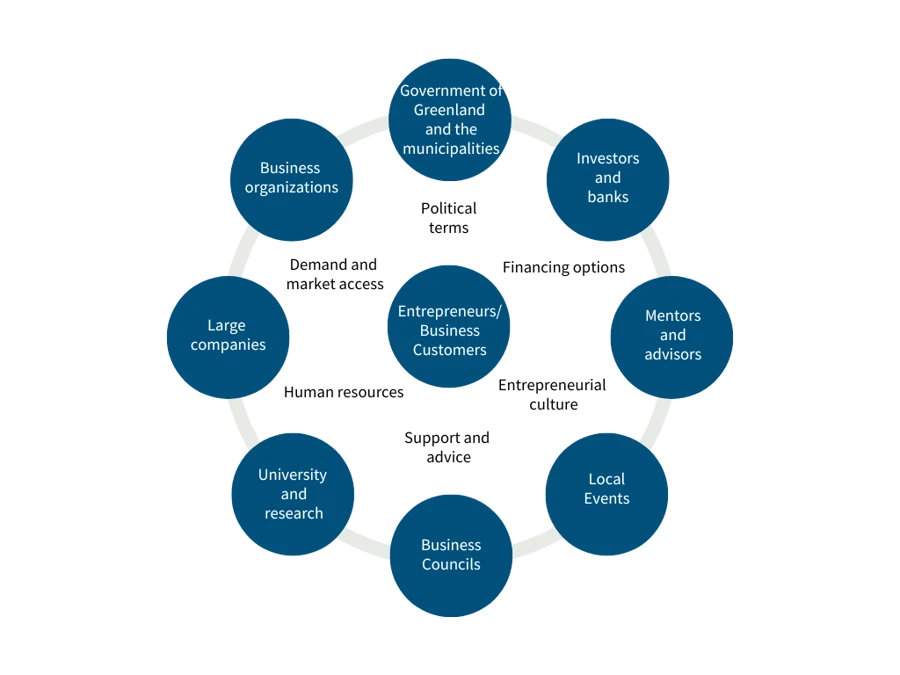

The entrepreneurial ecosystem

As an entrepreneur, you typically get the best support from other entrepreneurs who have been in the same situation themselves.

However, you often also need help with the administrative side, such as through an accountant or auditor.

You can benefit from engaging in dialogue with public business consultants in your municipality and Nalik Ventures about their opportunities.

Additionally, there are many resources to be found by connecting with professionals from various fields. These could include researchers who can share their knowledge, event organizers who can provide you with a platform, or large companies that can help you market your products.